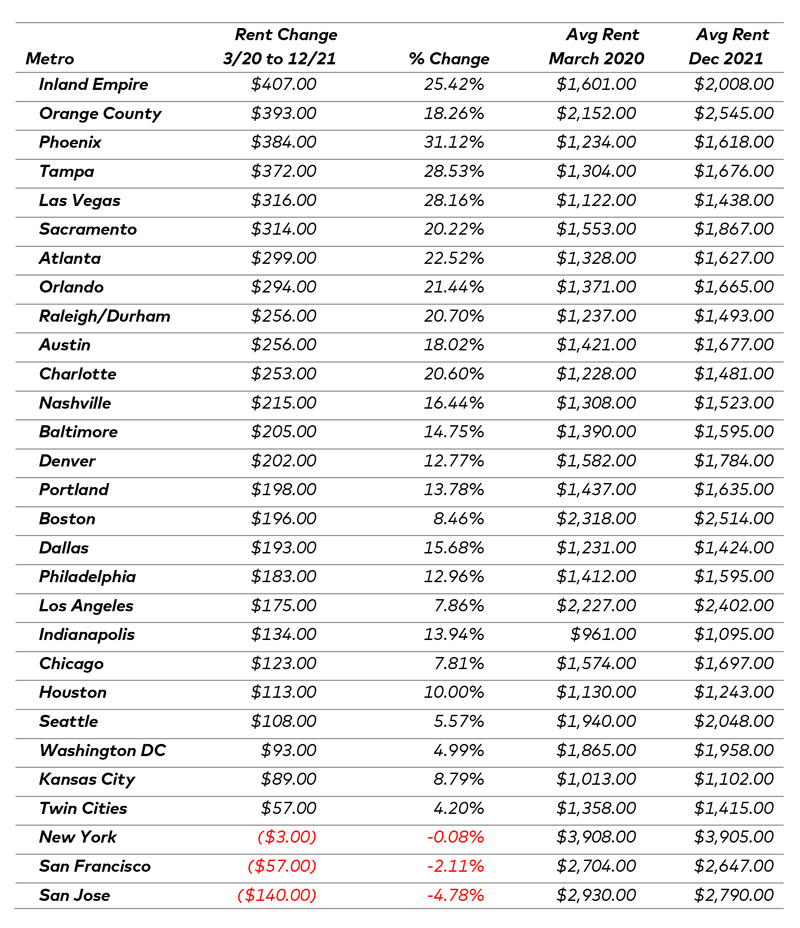

Asking rents will start 2022 well above pre-pandemic levels in most of the U.S. Between March 2020 and December 2021, asking rents in Yardi Matrix’s top 30 metros rose by $194, or 13.5%.

By metro, however, the differences are stark. Asking rents during that time increased by 20% or more in nine of the top 30 and 10% or more in 19 of the top 30. Meanwhile, in only four metros—large coastal centers San Jose, San Francisco and New York, and Midland, Texas—were current asking rents below pre-pandemic levels.

Two years ago, few could have imagined that COVID-19 would still be impacting daily lives or that it if did, apartment rents would be in a good spot. However, as we start 2022, multifamily rents are coming off record-breaking highs in 2021 with an optimistic outlook for the year ahead.

Looking at the universe of 147 metros tracked by Yardi Matrix, asking rents increased by 20% or more in just over one in five (29) and by 10% or more in almost three quarters (79). The only metros that remain below pre-pandemic asking rent levels are in the Bay Area (San Francisco and San Jose), New York City and Midland/Odessa, Texas, where rents are down by 22.5%.

Migration Shifts

The changes in rent since the pandemic started reveal much about demand and where growth could be concentrated going forward. Sheltering in place and working from home have loosened the link between home and work and limited the cultural advantages of large cities. That led to a migration from high-cost coastal centers starting in the spring of 2020. Where households are going can be seen by rent growth data.

The top choices are the South and Southwest. These secondary and tertiary markets feature a lower cost of living than gateway metros, attractive weather and geography, and a growing base of jobs as corporations expand there.

Another type of migration occurred between expensive coastal markets and nearby secondary markets that are less expensive. In this type of migration, people move further from job centers but within occasional commuting distance for flexible jobs. Or they are willing to make longer commutes in exchange for larger or less expensive apartments.

An Enduring Trend?

Where this all goes is unpredictable. As demonstrated by the onset of the Omicron wave, forecasting the end of the pandemic is difficult. New waves of the virus may impact corporate policies regarding remote work—more are delaying going back to the office or even implementing permanent fully remote policies. That could continue to drive migration away from large job centers.

In-migration continues to be a big factor. Fewer people moved to urban centers during the pandemic, even as more moved out. Post-pandemic, immigration could pick up and make up for households moving out. if the pandemic continues to affect commerce and travel, future migration will remain unpredictable. Clearly, however, the growth in metros in the South and West is not likely to abate.

Read the full analysis: Pandemic Rent Growth Highlights Migration Patterns

Add Comment