Multifamily is red-hot in 2021, as strong demand and robust economic growth has rents growing at their fastest rate in six years.

According to Yardi Matrix, the average U.S. multifamily rent rose $12 in May to $1,428. Rents are up 2.2 percent year-to-date through May and are now up 2.5 percent year-over-year, per Yardi, the highest annualized rate of growth since the onset of the COVID-19 pandemic.

Tenant demand for multifamily is sizzling across the U.S. in 2021, with the strong absorption extending into many of the Gateway markets that saw an exodus of renters the prior year, according to Yardi Matrix’s database.

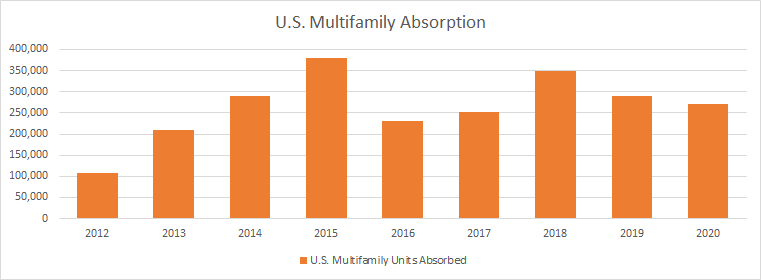

Through the end of April, nearly 120,000 multifamily units were absorbed nationally in the 136 markets covered by Matrix. That puts the industry on pace for one of its best years since the 2008 recession, and the industry should easily top the 270,000 units absorbed last year.

Demand in 2021 is led – not surprisingly – by Dallas, with 8,200 apartment units absorbed in the first four months. Dallas has been among the metros with the highest growth in employment and population many years. Other rapidly growing metros among the leaders in absorption through April include Miami (5,700), Atlanta (5,400), Phoenix (4,600) and Austin (4,500). Nashville, at 2.1 percent, led in absorption as a percentage of total stock. Other leaders in that metric were Chicago, Charlotte, and Miami (1.9 percent each) and Austin (1.8 percent).

Year-over-year rent growth is led by Inland Empire (10.2 percent), Phoenix (9.6 percent) and Sacramento and Los Vegas (each 8.3 percent). Inland Empire, Las Vegas, and Sacramento have drawn tenants moving from expensive California gateway metros, while Phoenix continues to attract population and job growth.

Gateway Rebound

Perhaps most encouraging, however, is the rebound in large high-cost Gateway metros in which absorption was negative in 2020 due to the pandemic. Chicago, for example, was second to Dallas with just under 7,000 units absorbed through April, after posting negative (-1,800) demand numbers in 2020. The rebound can be seen in the rents, which grew 1.1 percent in Chicago in May, and are up 0.8 percent on a three-month trailing basis, per Yardi.

Other gateway metros with strong numbers year-to-date are San Francisco, which had 3,400 units absorbed in 2021 after -2,200 in 2020; San Jose, which absorbed 1,300 units year-to-date after -2,000 in 2020; and New York, which has absorbed 2,400 units through April after -16,000 in 2020. Washington D.C. (4,500 units absorbed through April), Los Angeles (4,000) and Boston (3,100), also have far surpassed 2020 performance so far this year.

Like Chicago, rents in New York are snapping back after dropping nearly 15 percent in the year following the pandemic. Average New York asking rents increased a whopping 3.4 percent in May and are up 1.1 percent on a three-month training basis, per Yardi.

High-rent metros with large central business districts saw a wave of move-outs and little in-migration in 2020 as office buildings largely emptied due to COVID-19 restrictions. As vaccination programs are rolled out, cities are re-opening, and the evidence is that people are starting to return. Although it may take months or years to recover, positive demand is a welcoming sign for apartment owners in urban markets.

Continued Apartment Demand

Since 2013, when recovery from the Great Recession began in earnest, the U.S. has averaged 283,000 multifamily units absorbed. The pandemic didn’t impact the overall number as much as was feared, given the downturn in the economy and loss of 20 million jobs at various points, but it created a bifurcation with demand concentrated in secondary and tertiary markets and suburban parts of large metros.

In 2020, absorption was positive, at 2.3 percent of total stock, in secondary and tertiary metros, while absorption was negative in Gateway metros (-0.2). Rent growth was highest in smaller, less-expensive markets. Tertiary metros saw rents grow 3.1 percent in 2020, compared to 0.4 percent in secondary metros and -6.1 percent in Gateway markets.

Those numbers are flipped somewhat in 2021. Year-to-date demand has been led by Gateway and secondary metros, which have absorbed 1.0 percent of stock, with tertiary markets absorbing 0.6 percent of stock. Rent growth still favors the less-expensive metros, however. Rents in tertiary markets have grown 2.0 percent year-to-date through April, compared to 1.6 percent in secondary metros and 0.1 percent for Gateway markets. It appears that demand remains focused in properties with rents that are affordable for middle- and lower-income households.

The robust absorption numbers are reflected in apartment rent growth, which has rebounded strongly in 2021. Nationally, rents are up 1.6 percent year-to-date, reaching an all-time high of $1,417, according to Matrix.

Add Comment