Buoyed by changing social and technological trends and exacerbated by the COVID-19 pandemic, industrial real estate has evolved in recent years from a slow-moving and stable asset class to one with dynamism and rapid growth. That has drawn the attention of the largest and most opportunistic investors, which have jumped into the industrial segment in force in recent years.

The influx of institutions demonstrates that some of the largest and most sophisticated commercial real estate investors have determined that the industrial surge is no flash in the plan. A considerable amount of smart money is betting that the growth in industrial real estate is still in its beginning stages.

Demand Underpins Growth

Underpinning the industrial investment revolution is the sector’s fundamentals, which are driven by demand emanating from the growth in e-commerce that has been accelerated by the pandemic. The growth in e-commerce has increased demand for well-located logistics space with high ceilings and modern technology with robotics and sorting suitable for distribution.

According to a new industrial space demand forecast published by the NAIOP Research Foundation, net absorption rates in industrial reached their highest levels since 2000, with higher rents and low vacancy rates. The report projects total net absorption in 2021 to be 314.9 million square feet, with a quarterly average of 78.7 million square feet. In 2022, net absorption is projected to be 231.6 million square feet, with a quarterly average of 57.9 million square feet.

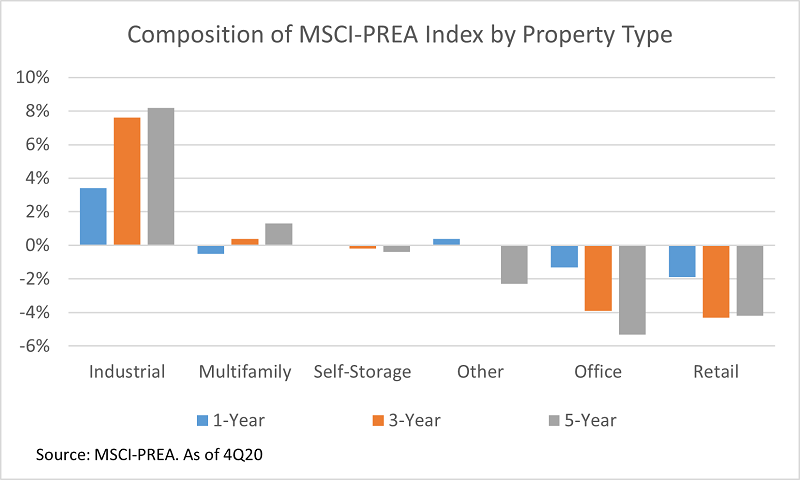

Industrial sector has also led commercial real estate property types in returns over the last one-, three- and five-year periods. As of year-end 2020, industrial investments in the MSCI PREA U.S. AFOE Quarterly Property Fund Index produced annual returns of 11.4% for one year, 13.0% over three years and 12.8% over five years. The total index produced annual returns of 2.4% for one year, 5.4% for three years and 6.3% for five years.

Eager for Industrial Loans

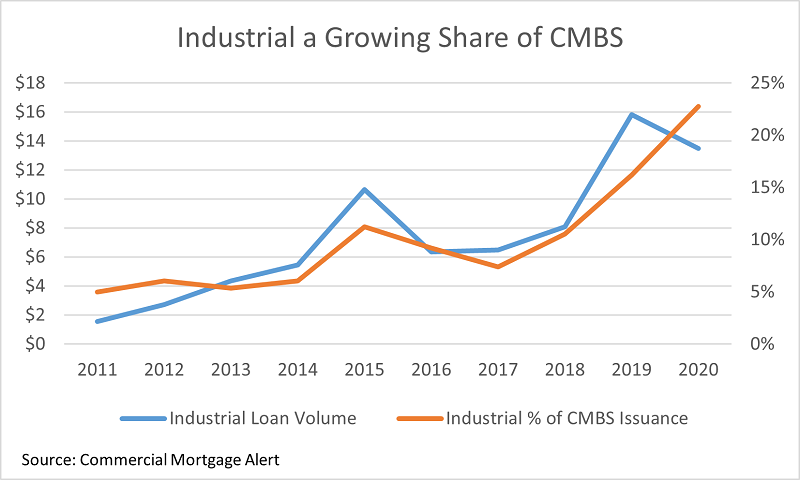

Industrial is also taking up a greater amount of debt capital because lenders are eager to hold in their portfolios loans on what is considered an exceptionally safe asset class. While all commercial lending was down by 30% in 2020 and by 18% year-over-year in the fourth quarter, lending on industrial properties was only down 18% for the year and was up 15% in 4Q20 compared to a year earlier, according to the Mortgage Bankers Association.

Industrial’s share of CMBS is growing. Loans backed by industrial properties comprised more than 10.5% of annual CMBS issuance only once between 2000 and 2018, with a high of 11.2% in 2015, according to Commercial Mortgage Alert (CMA). However, the market share of industrial loans increased to 16.2% in 2019 and a record 22.7% in 2020.

Industrial real estate has been a beneficiary of social trends. Shopping seems a good bet to change permanently. As a result, occupier and investor demand for industrial real estate seems destined to take up a larger share of commercial real estate capital.

A more detailed version of this article can be found on the blog of the National Association for Industrial and Office Properties (NAIOP): https://blog.naiop.org/2021/03/industrial-in-an-investment-revolution/

Add Comment